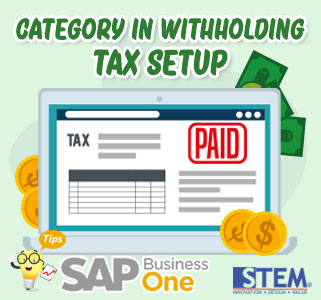

When you create Withholding Tax codes in SAP Business One, there is a field called ‘Category’ where you have to fill it by choosing Invoice or Payment.

Do you know the differences between these categories?

SAP Business One Tips – Category in Withholding Tax Setup

If you select Invoice,

The withholding tax calculation appears in the invoice and is recorded in the journal entry when the invoice is added.

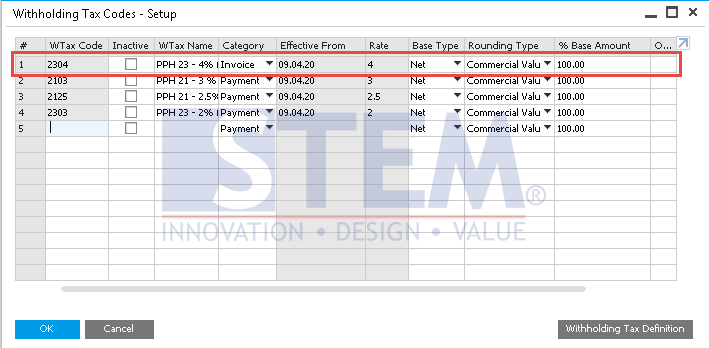

For example, you select Invoice as Category for Wtax 2304:

SAP Business One Tips – Category in Withholding Tax Setup

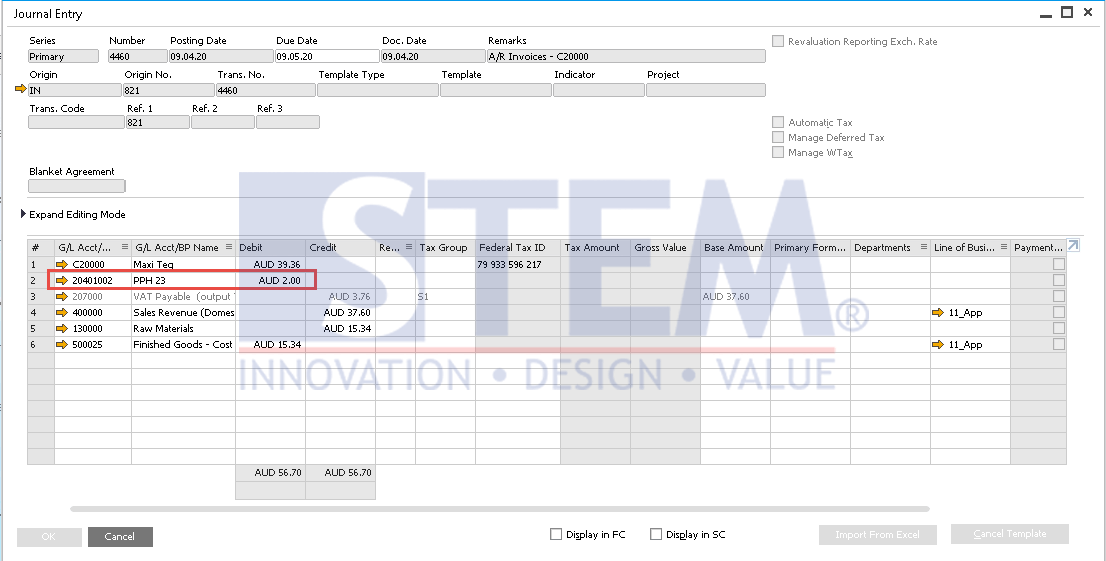

Then when you create an AR Invoice transaction in SAP Business One and choose 2304 as the WTax, withholding tax calculation is recorded in the Journal Entry when the invoice is added.

And the Journal Entry will be showed like this:

SAP Business One Tips – Category in Withholding Tax Setup

But if you select Payment as the category,

The withholding tax calculation appears in the invoice but is recorded in the journal entry when it is created by the incoming payment based on that invoice.

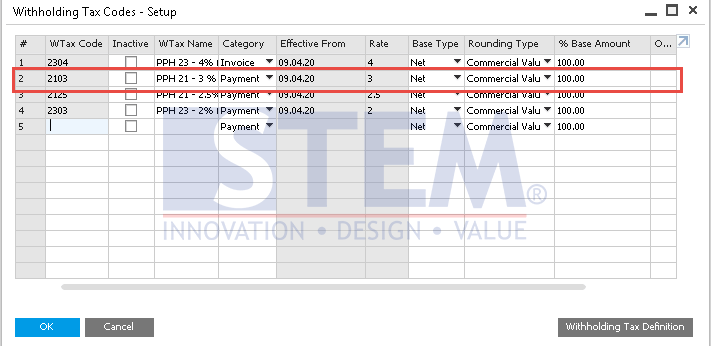

For example, you select Payment as Category for Wtax 2103:

SAP Business One Tips – Category in Withholding Tax Setup

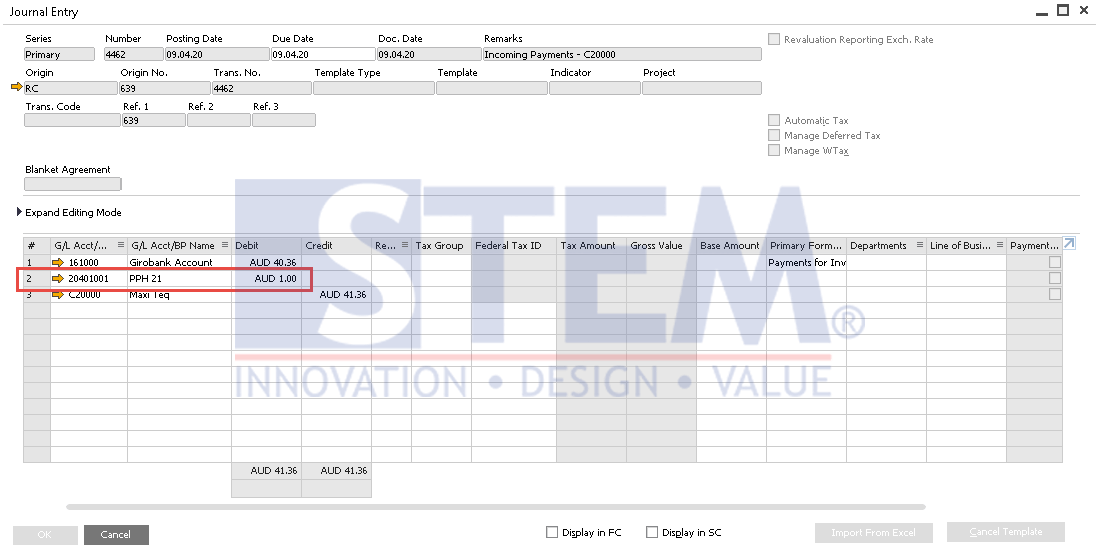

Then when we create an Invoice transaction and choose 2103 as the WTax, withholding tax will be calculated when you create the invoice. But it will be recorded in the journal entry when the payment is created.

After creating the payment, the Journal Entry will be shown like this:

SAP Business One Tips – Category in Withholding Tax Setup