In SAP Business One, you can choose how you want to calculate your item cost.

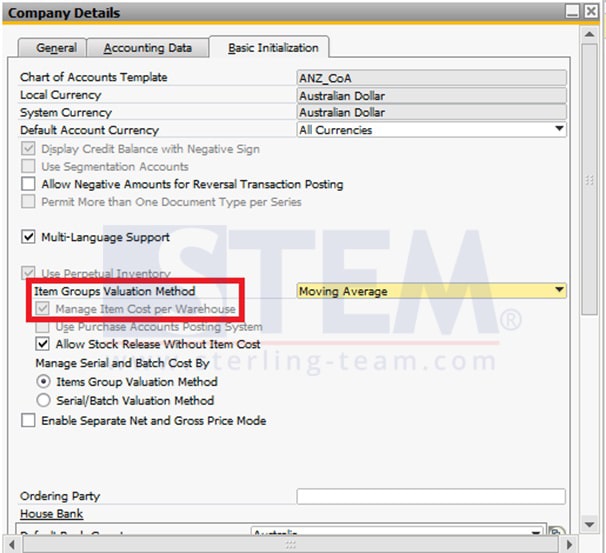

To determine item cost calculation method, you can go to: Administration > System Initialization > Company Details > Basic Initialization tab.

There are two item cost calculation method in SAP Business One:

- If the checkbox Manage Item Cost per Warehouse is not selected, then the item cost is calculated per company.

- If the checkbox Manage Item Cost per Warehouse is selected, then the item cost is calculated per warehouse.

If your item cost is managed per company, the item cost calculation is based on transactions from all warehouses and the cost is equal in all warehouses.

But, if your item cost is managed per warehouse, the item cost is calculated for each warehouse separately, based on transactions posted to the given warehouse.

Please note that this rule only valid when your item valuation method is using Moving Average or FIFO or Standard. If your item is managed as a batch item and your item valuation method is using Serial/Batch, the Serial/Batch cost is calculated based on all receipts from all warehouses to same batch.

Before choosing item cost calculation method, you should answer the below questions:

- Do you plan to assign different inventory account to each warehouse in order to view it in various reports? (e.g.: balance sheet, inventory audit report)

- Do you need, due to any business/legal requirement, to report the inventory value for each warehouse separately?

- Do you need the inventory audit report to be grouped by warehouse?

- Do you need to generate material revaluation to each warehouse separately?

If the answer to all the questions is ‘yes’ then it is recommended to calculate your item cost by warehouse.

NOTE:

Once inventory posting was generated in the company database, the settings made in “Use Perpetual Inventory” and “Manage Item Cost per Warehouse” are not able to be undone.

Also read: