Inventory Revaluation is the process of adjusting inventory values in the SAP Business One system to reflect changes in the cost of goods owned by the company. This process is necessary when there are price changes that affect the value of inventory stored in the system. Inventory Revaluation is required in the following situations:

- Changes in Pricing Policies or Market Value of Inventory – When a company decides to change the price of certain goods or if the market value or actual cost of inventory changes significantly (market fluctuations and inflation), adjustments are needed to reflect market conditions or more accurate costs.

- Obsolete or Damaged Goods – If there are indications that the value of inventory has decreased, for example, due to damaged or obsolete goods, Inventory Revaluation can be used to reflect the lower value in accounting records.

- Correction of Recording Errors – If errors are found in the previous cost recording of goods.

- Compliance with Financial Reporting Standards – To ensure financial reports reflect accurate inventory values.

- Inventory Adjustment Due to Changes in Accounting Policies – If there is a change in accounting policies related to inventory valuation, such as the adoption of a different valuation method, revaluation is required to adjust the inventory value according to the new policy.

- End of Accounting Period or Fiscal Year – As the accounting period or fiscal year approaches its end, a company may perform Inventory Revaluation to ensure that inventory values reflect current conditions before preparing financial reports.

- Merger or Acquisition – If a company undergoes a merger or acquisition that causes significant changes in cost structure or inventory value, revaluation may be required to reflect the new conditions.

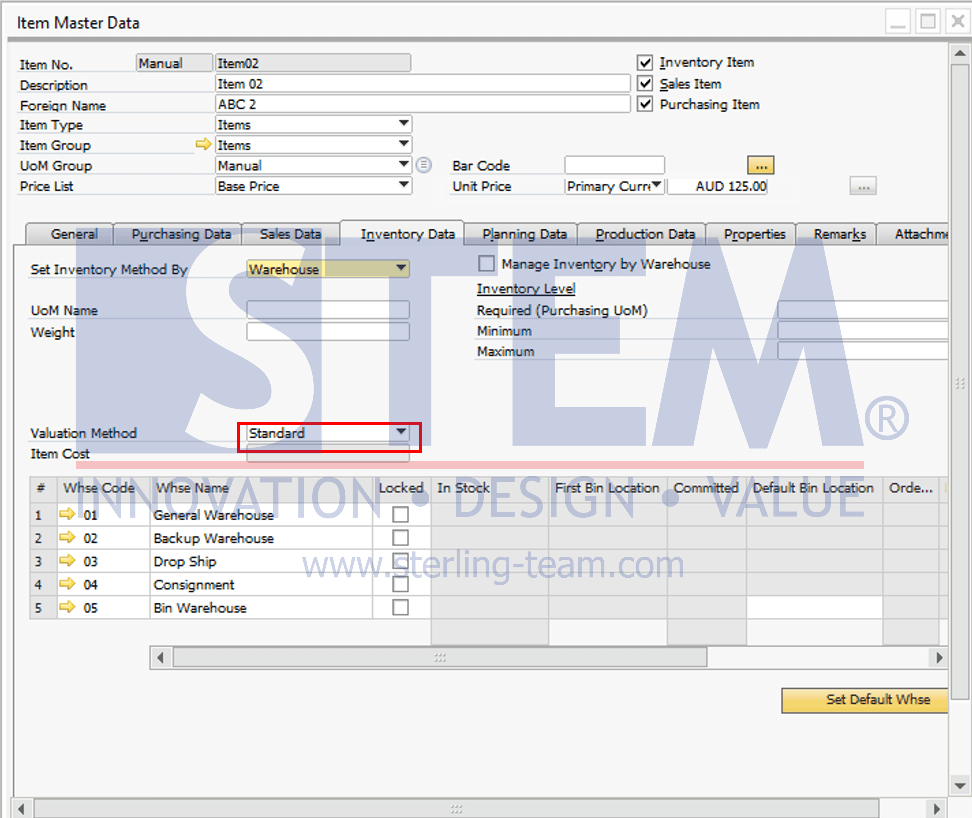

For example, if the Valuation Method of an item is changed from Moving Average Price to Standard Price due to significant price fluctuations. To change the Valuation Method, ensure that:

- The stock is empty in all warehouses.

- There are no open inventory transactions related to the item whose Valuation Method will be changed.

If there are remaining stock or pending transactions, the Valuation Method field will be disabled and cannot be changed.

When updating the Valuation Method in the Item Master Data to Standard, the system will display a message.

This means that because the valuation method is changed to Standard, a Standard Cost must be determined by creating an Inventory Revaluation document.

This means that because the valuation method is changed to Standard, a Standard Cost must be determined by creating an Inventory Revaluation document.

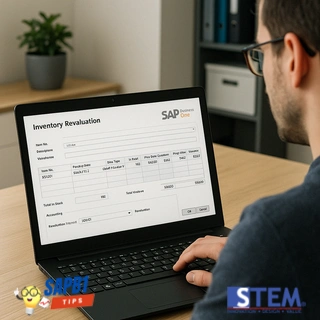

Here are the steps to perform Inventory Revaluation in SAP Business One:

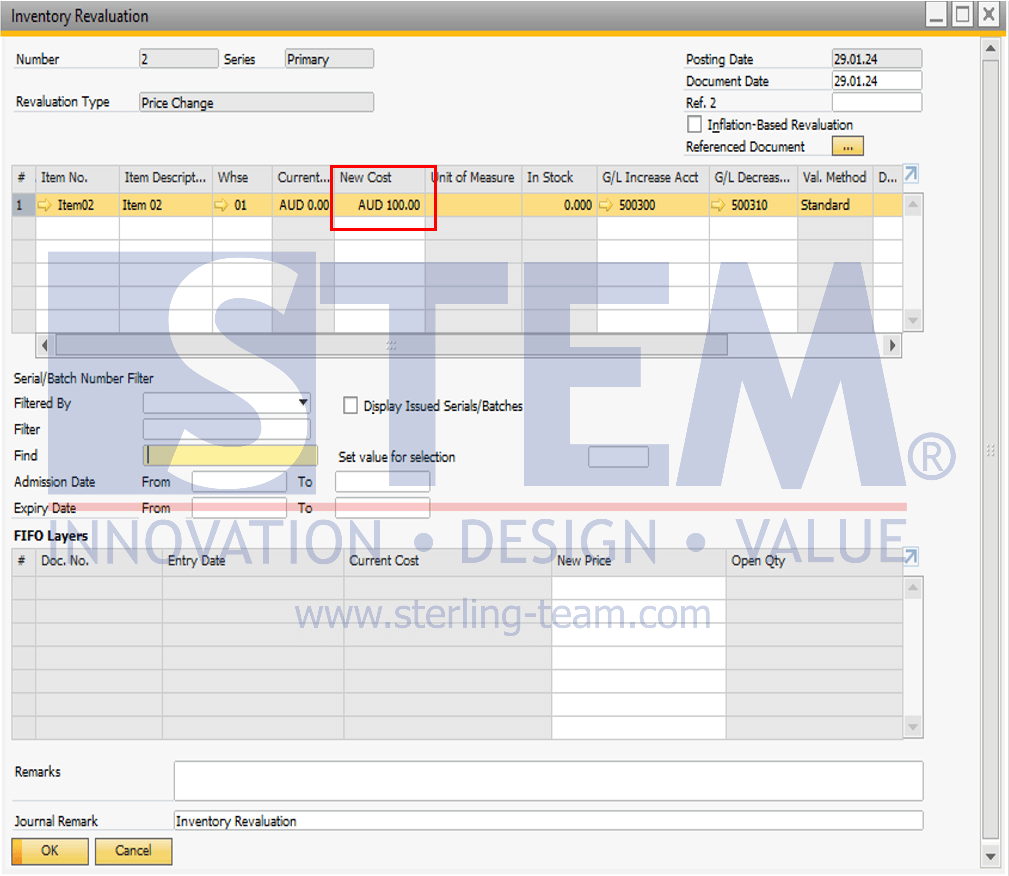

- Navigate to Inventory > Inventory Transactions > Inventory Revaluation.

- In the Inventory Revaluation screen, select the item for which the Item Cost will be changed.

- Enter the new price for the item in the New Cost

- If Item Cost is based on Warehouse Level, specify which warehouses the new price applies to. If the new price applies to multiple warehouses, for example, five warehouses, enter the item data in five rows for each warehouse. The warehouse code can be entered in the Whse.

- If there is a difference between the old price and the new price, the system will automatically calculate it. The value difference will be recorded in the Inventory Revaluation Gain/Loss account or another account according to company policy.

- Ensure all information is correct, then click the Add button to save the revaluation document.

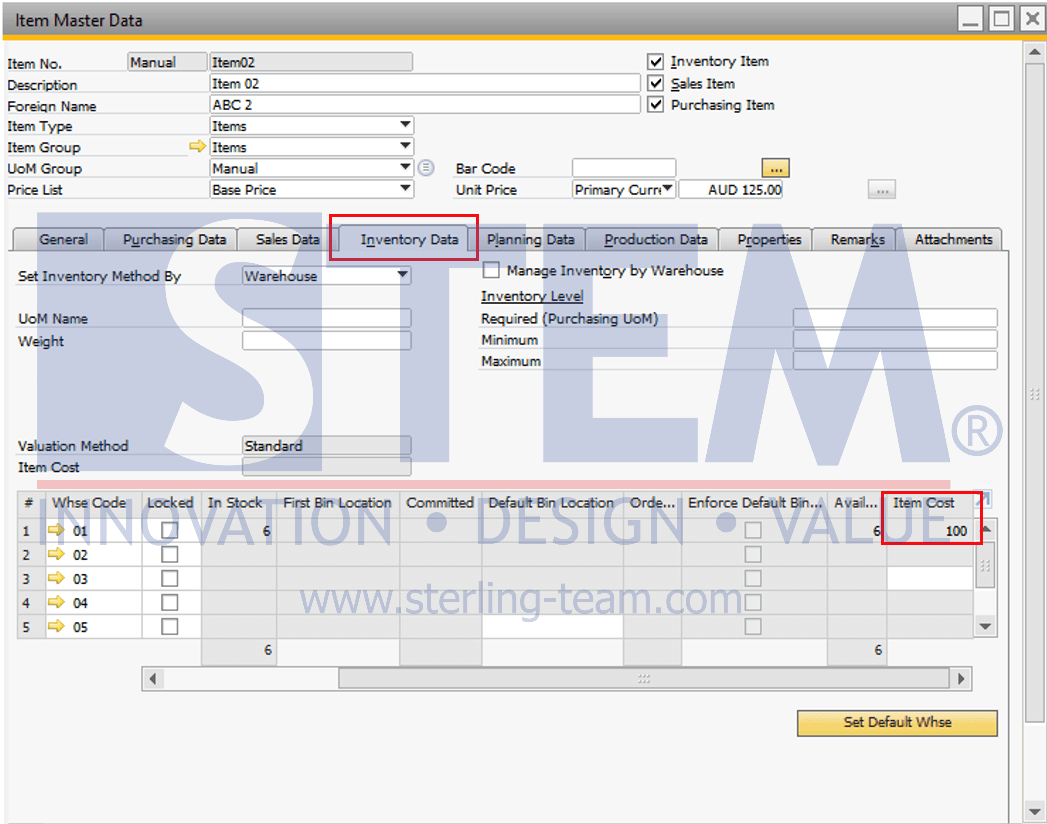

- Recheck Item Master Data, Inventory Data Tab. The Item Cost has been updated according to the cost entered in the Inventory Revaluation.

Also read:

- Item Cost Calculation Method in The Perpetual Inventory System SAP Business One

- Item Group Valuation Methods

- Restrict Receiving Same Item Batch in SAP Business One

- Set Item Cost for Not-Based Returns

- Allowing Stock Release Without Item Cost