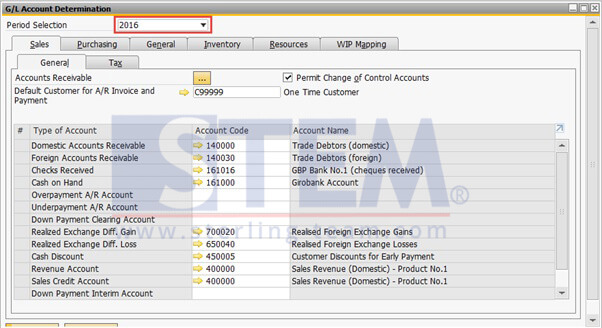

If you’re still in development phase and your client company need to use G/L account determination, you should setup the G/L Account determination first before declaring another period.

By doing so, you save the time to setup account in yearly G/L account determination.

Here’s the simple illustration :

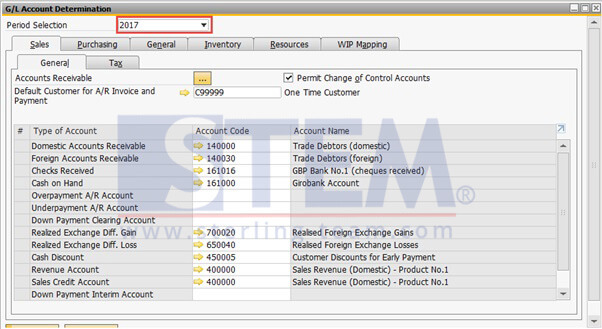

Setup G/L Account Determination BEFORE add posting Period :

Setup G/L Determination on B1 (before add posting period)

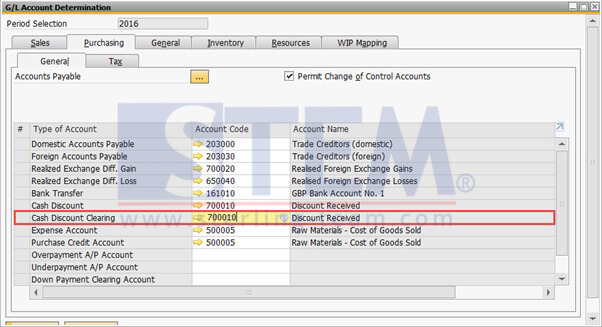

Setup G/L Account Determination AFTER add posting Period :

Take a look on “Cash Discount Clearing” Account Code

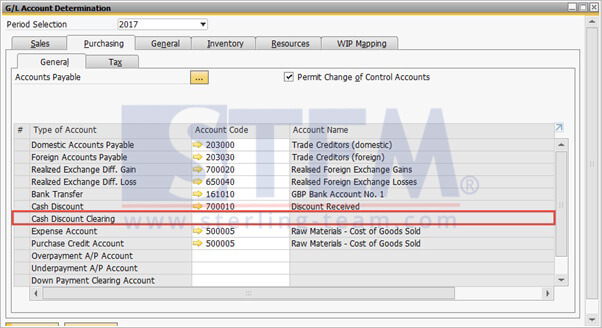

Newly added G/L Account for cash discount clearing. And when we see the G/L Account year 2017, it shows blank. So, we need to input it manually as well.

So, always remember, it will be more convenient and easier for setup the G/L Account determination first before declaring another posting period.

Also read: