In the previous discussion, we discussed the Direct Method in the Statement of Cash Flow in SAP Business One.

In part 2, we will continue discussing the Indirect Method.

In this method, statement of cash flow is generated by utilizing changes in balances from the beginning of the period to the end of the period. To use this method, you need to create a Financial Report Template. The process is a bit lengthy, but the report can immediately be used once it is set up.

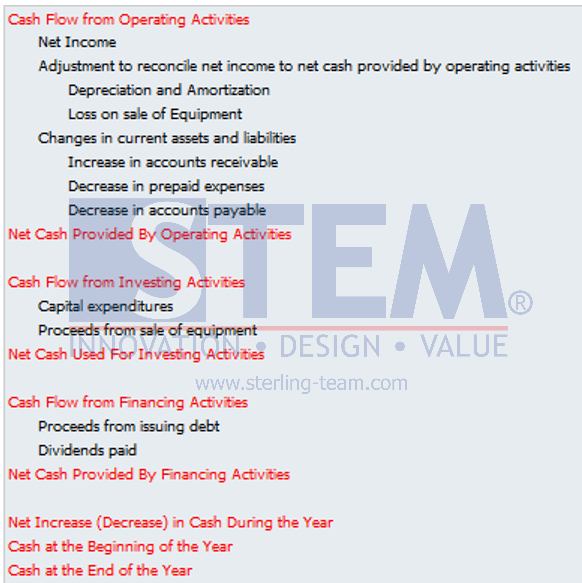

Example of cash flow line item arrangement using the Indirect method:

The following are the steps to configure the Indirect Method:

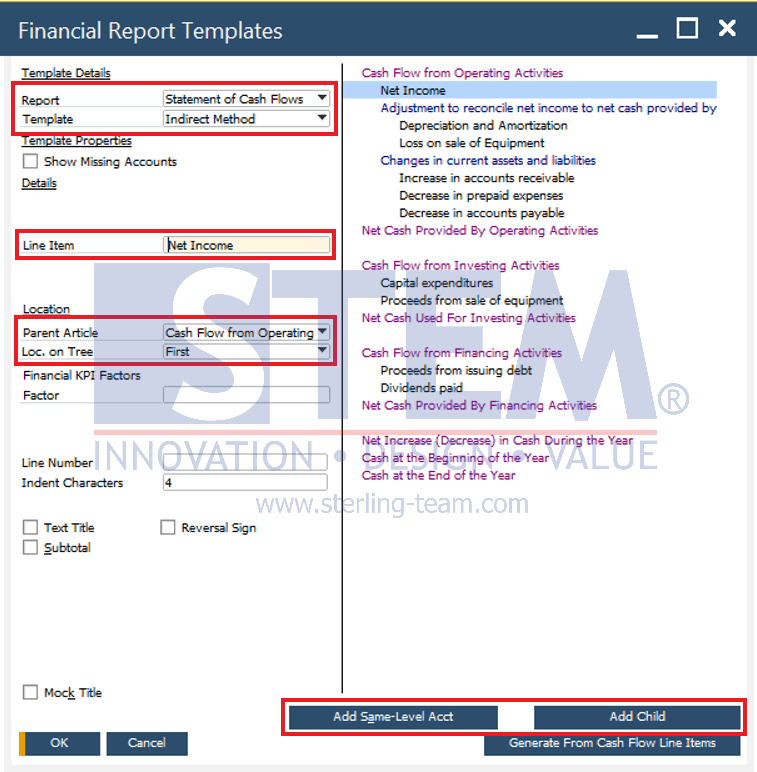

- Create Financial Report Templates via the Financials > Financial Report Templates In the Report Field, select Statement of Cash Flows, name the template in the Template field by selecting Define New.

- Add and adjust line items according to the desired report format.

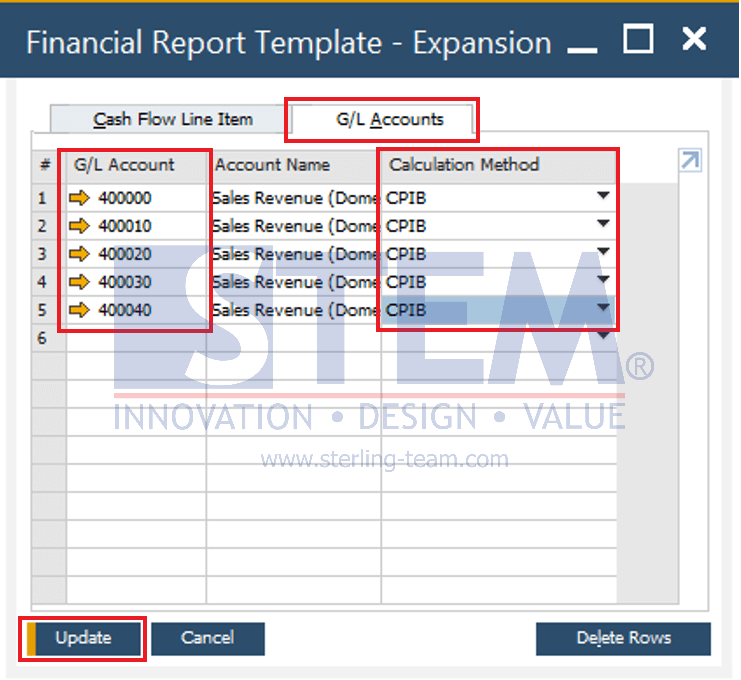

- To link line items with G/L Account, double click line items on the right side of the screen. The Financial Report Template – Expansion screen appears. Go to the G/L Accounts

- Select the appropriate G/L Account and Calculation Method. The options for Calculation Method are:

- Beginning of Period

- End of Period

- Current Period in Debit

- Current Period in Credit

- Current Period in Both

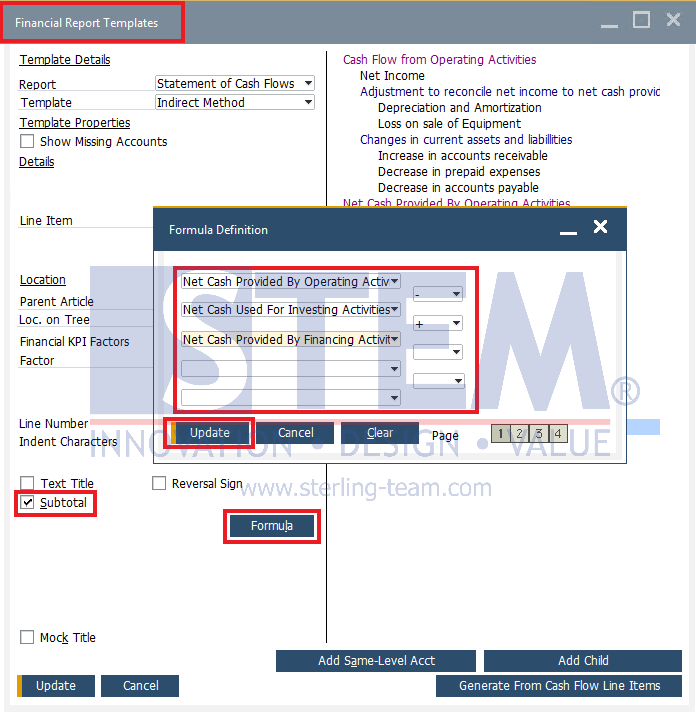

- In the Financial Report Template screen, tick Subtotal and click the Formula Then the Formula Definition screen will be displayed to enter the line item formula obtained from the calculation results.

- Save the template. This template can be used to open Statement of Cash Flows report.

Also read:

- Direct vs Indirect Method in Statement of Cash Flow (Part 1)

- Using Formula in Statement of Cash Flow Report

- Error Journal Entry with 2 or More Cash Flow Accounts

- Create Your Own Financial Statement Template