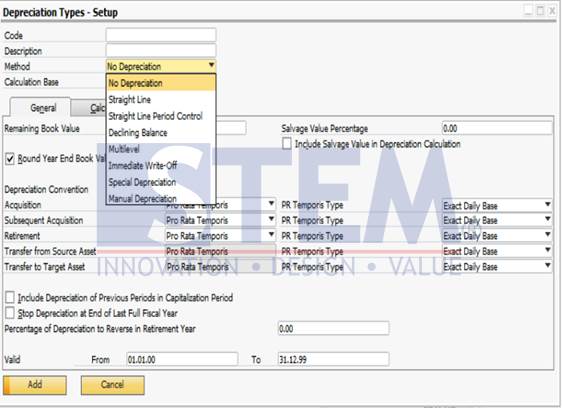

Not only to help the system to be integrated properly and quickly, SAP B1 also allows users to be able to depreciate their assets. There are several types of Depreciation that can be made by the user or that has been provided by the system. In the Depreciation Type section, there is a Method as a method of calculating the depreciation.

Fig. 01 – Depreciation Method

Following is an explanation of the parts of the Method:

- No Depreciation: If this method is chosen, the depreciation type that will be used will not carry out the depreciation function

- Straight Line: The method of distributing the value of an asset equally over its useful life. That is, assets are depreciated by the same amount in each period.

- Straight-Line Period Control: A method that requires defining various factors used in calculating depreciation for different periods of useful life of assets.

- Declining Balance: A method that requires applying a depreciation level to an asset that is not depreciated.

- Multilevel: Instead of distributing asset costs evenly over their useful life, this method depreciates assets at a constant rate, which results in a decrease in depreciation costs each successive period.

- Immediate Write-Off: A method that is generally applied to low-value assets whose full value can be depreciated in the year of acquisition.

- Special Depreciation: Metode pelaksanaan penyusutan khusus otomatis.

- Manual Depreciation: The method of implementing special automatic depreciation.

Also read: